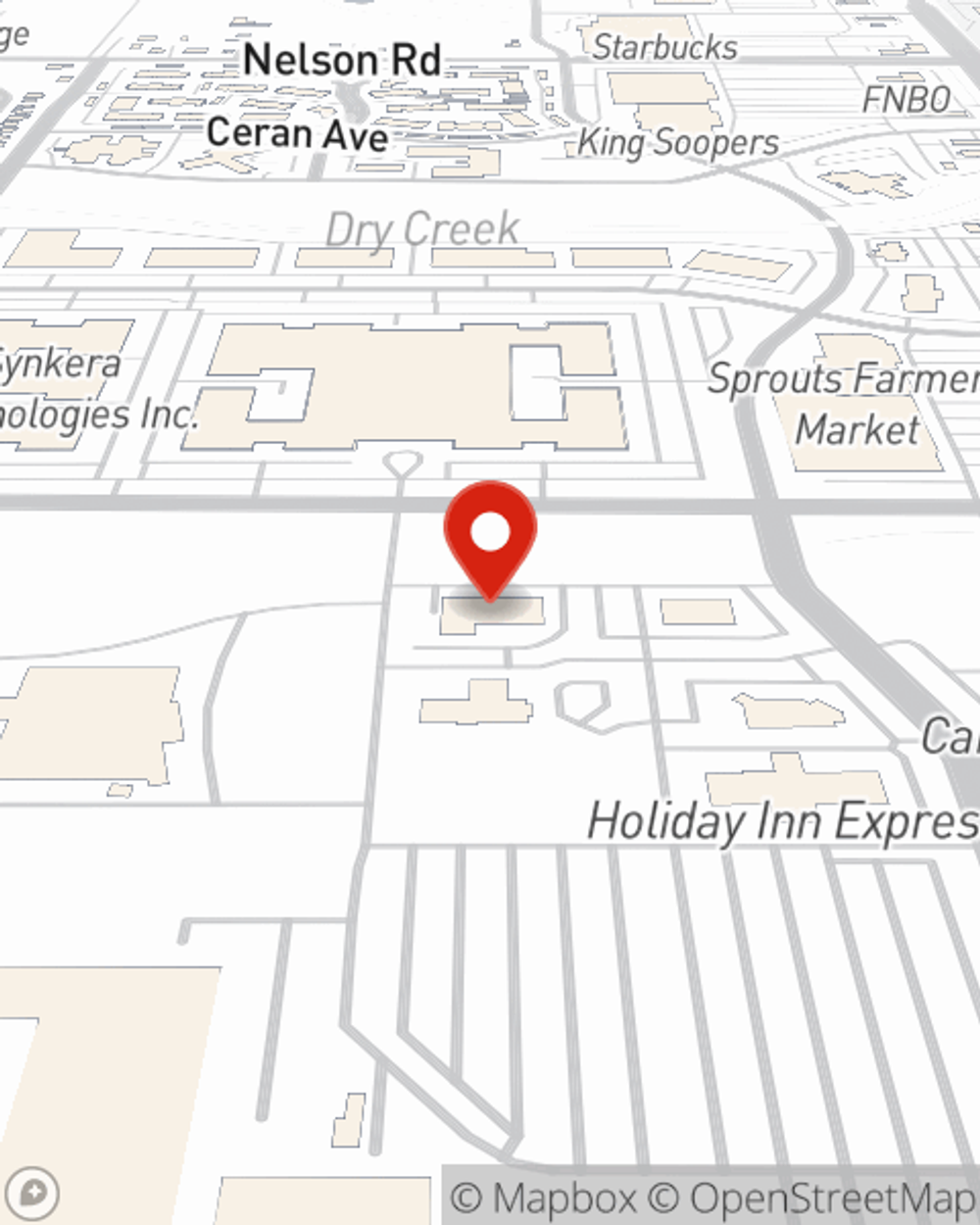

Business Insurance in and around Longmont

Get your Longmont business covered, right here!

Insure your business, intentionally

- Longmont

- Louisville

- Boulder

- Niwot

- Mead

- Berthoud

- Frederick

- Firestone

- Lyons

- Lafayette

- Erie

- Gunbarrel

Help Protect Your Business With State Farm.

Operating your small business takes hard work, commitment, and outstanding insurance. That's why State Farm offers coverage options like extra liability coverage, errors and omissions liability, worker's compensation for your employees, and more!

Get your Longmont business covered, right here!

Insure your business, intentionally

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Jennifer Paris for a policy that protects your business. Your coverage can include everything from errors and omissions liability or extra liability coverage to key employee insurance or employment practices liability insurance.

Ready to learn more about the business insurance options that may be right for you? Call or email agent Jennifer Paris's office to get started!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jennifer Paris

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.